Scholarship Tax Credits

It's an Opportunity that More Taxpayers Need to Know About

In the State of Illinois, with every donation made to fund a private school scholarship for grades K-12,

donors can receive an Illinois tax credit of 75 percent.

What is a Tax Credit?

A tax credit is a voucher, typically offered as a government incentive, that allows taxpayers to directly reduce their taxes. This allows for a dollar-for-dollar exchange in reducing taxes owed, or a tax refund on taxes paid. Unlike tax deductions, which are affected by tax brackets and other factors, tax credits save the taxpayer the full amount of their value.

HOW DO I HELP MY SCHOOLS?

It's as easy as 1-2-3!

To apply for a tax credit, donors need to first have an account on mytax.illinois.gov. This process can take up to ten days and requires you to receive a Letter ID in the mail.

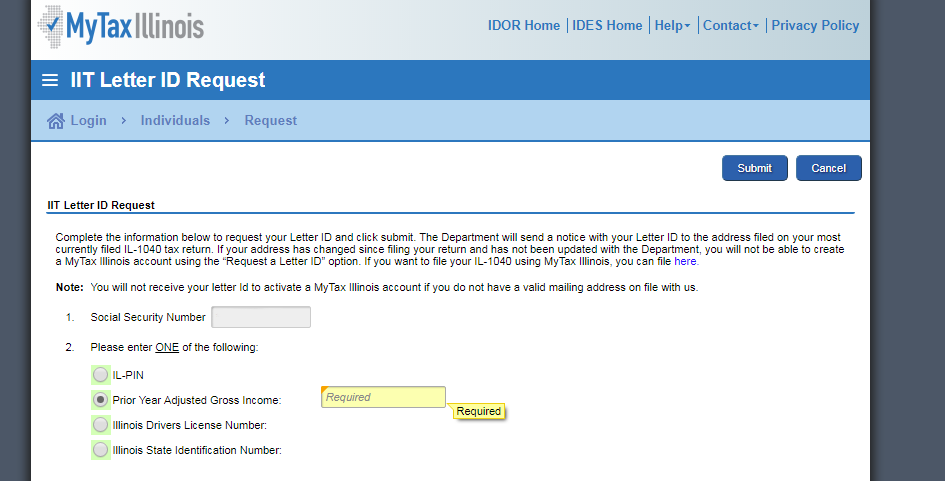

First, you will need to get your Letter ID. Please have the following:

- The Social Security Number (SSN) of the primary taxpayer.

- One of the Following:

- An Illinois State ID number

- An Illinois Drivers License number

- Your Adjusted Gross Income from 2016

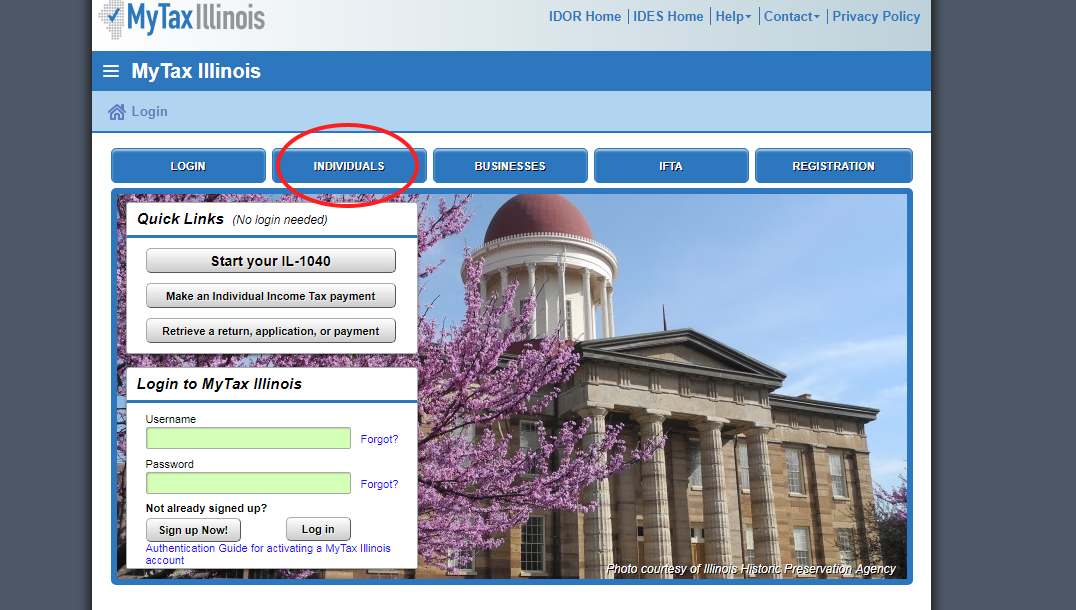

Navigate to mytax.illinois.gov. On the screen that appears, click "Individuals" on the navigation bar.

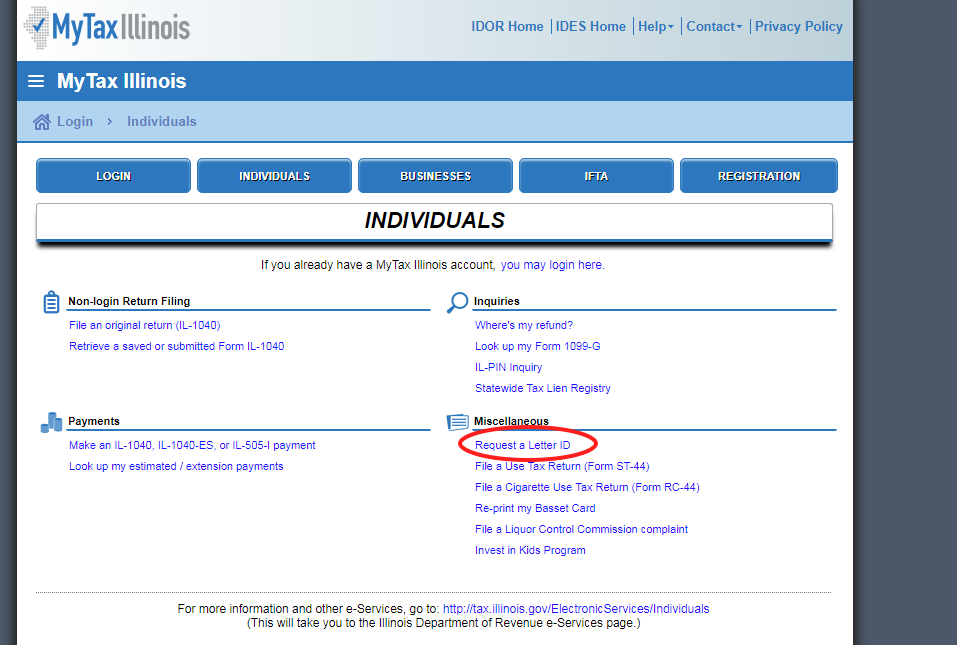

On the next page, click on "Request a Letter ID"

On this page, enter your SSN first. You will then be prompted to enter one of the additional numbers from above. When you submit this information, your Letter ID will be sent to the address on your most recently filed IL-1040 tax return. You should receive your Letter ID within 7 to 10 business days.

Second, you will need to use your Letter ID to activate your account.

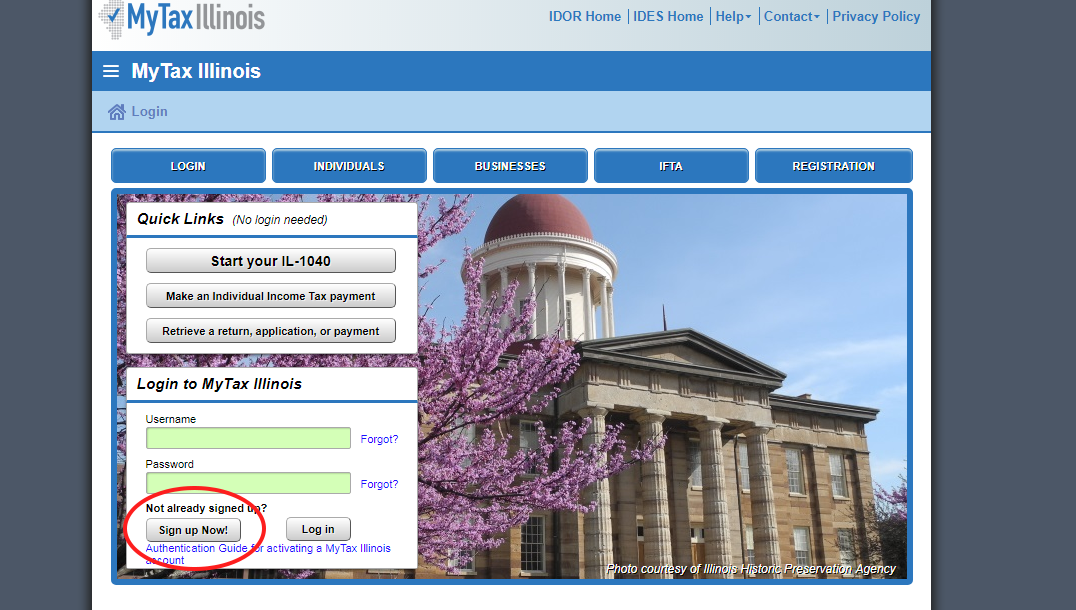

Navigate to mytax.illinois.gov. On the screen that appears, click "Sign up Now."

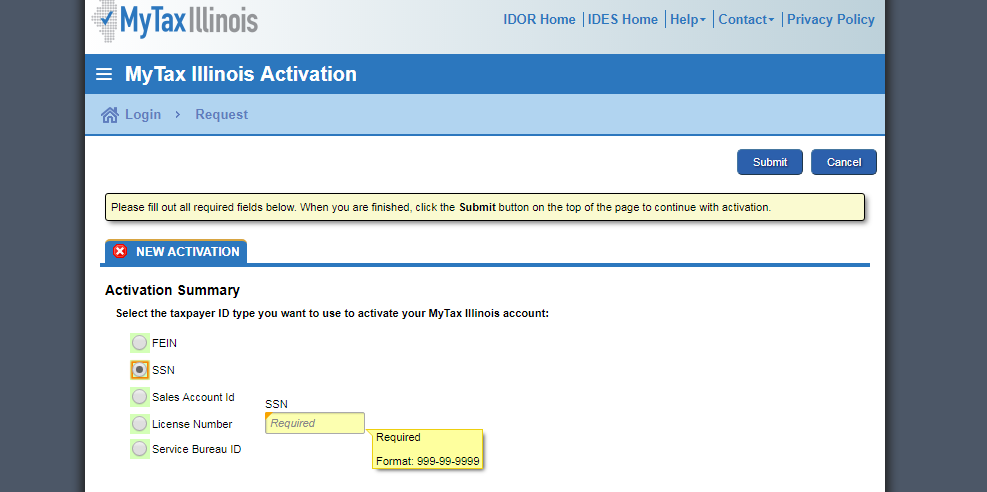

Choose your Taxpayer ID type and enter your number. After which, you will receive additional prompts. Fill out your information and hit submit. At this point you will set up your Username and Password. Make sure to record these for future use.

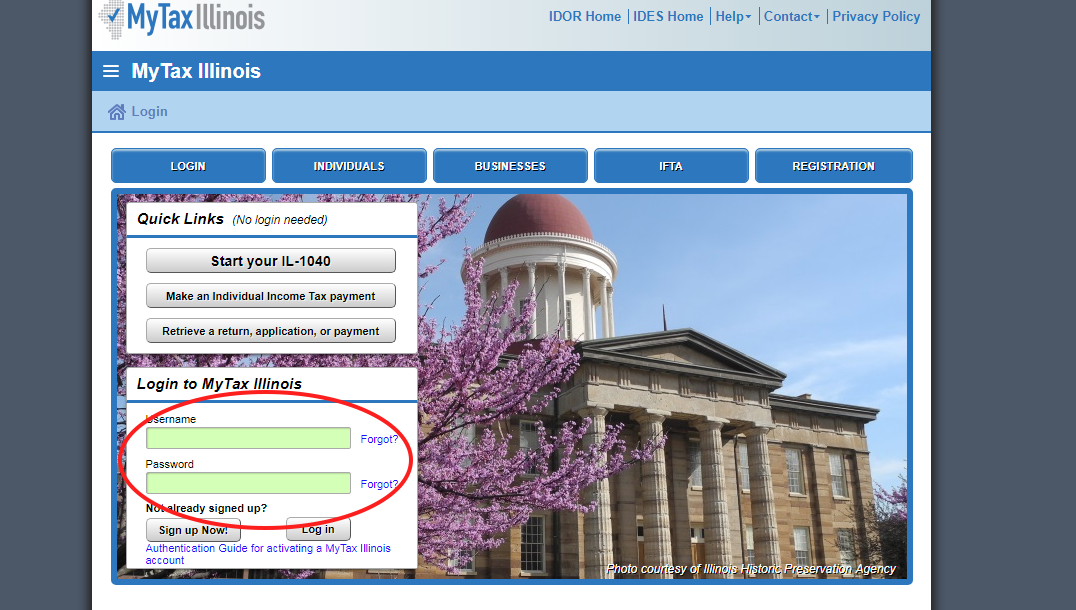

For this next step, navigate to mytax.illinois.gov in your browser. Enter your Username and Password in the boxes shown below.

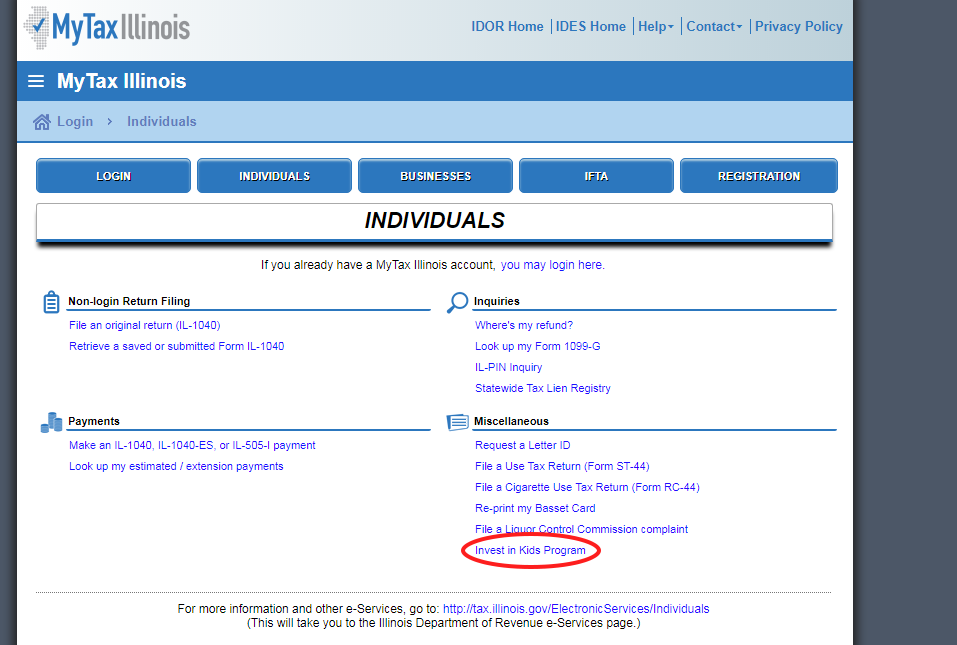

Next find the link "Invest in Kids Program" and click it.

On the next page, you will be prompted to select the Region where your funds will be designated. Select Region One for Cook County. Then select "Empower Illinois" as your Scholarship Granting Organization (SGO).

Enter your scholarship pledge. Your pledge should be made out to your full donation amount. This is the number the state will use to calculate your tax credit.

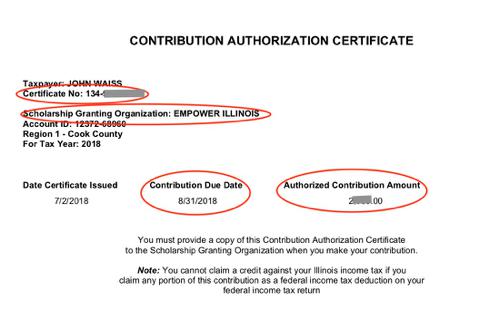

The Illinois Department of Revenue will send you an email within 3 business days. It will instruct you to log back onto your account and click on the "Correspndence" tab. Here you can view your Invest in Kids Contribution Authorization Certificate (CAC).

For this last step, make sure you have the following:

- You have reserved your tax credit on the My Tax Illinois website at mytax.illinois.gov

- You have your Contribution Authorization Certificate from the Illinois Department of Revenue

- You have Empower Illinois as the SGO on your Contribution Authorization Certificate

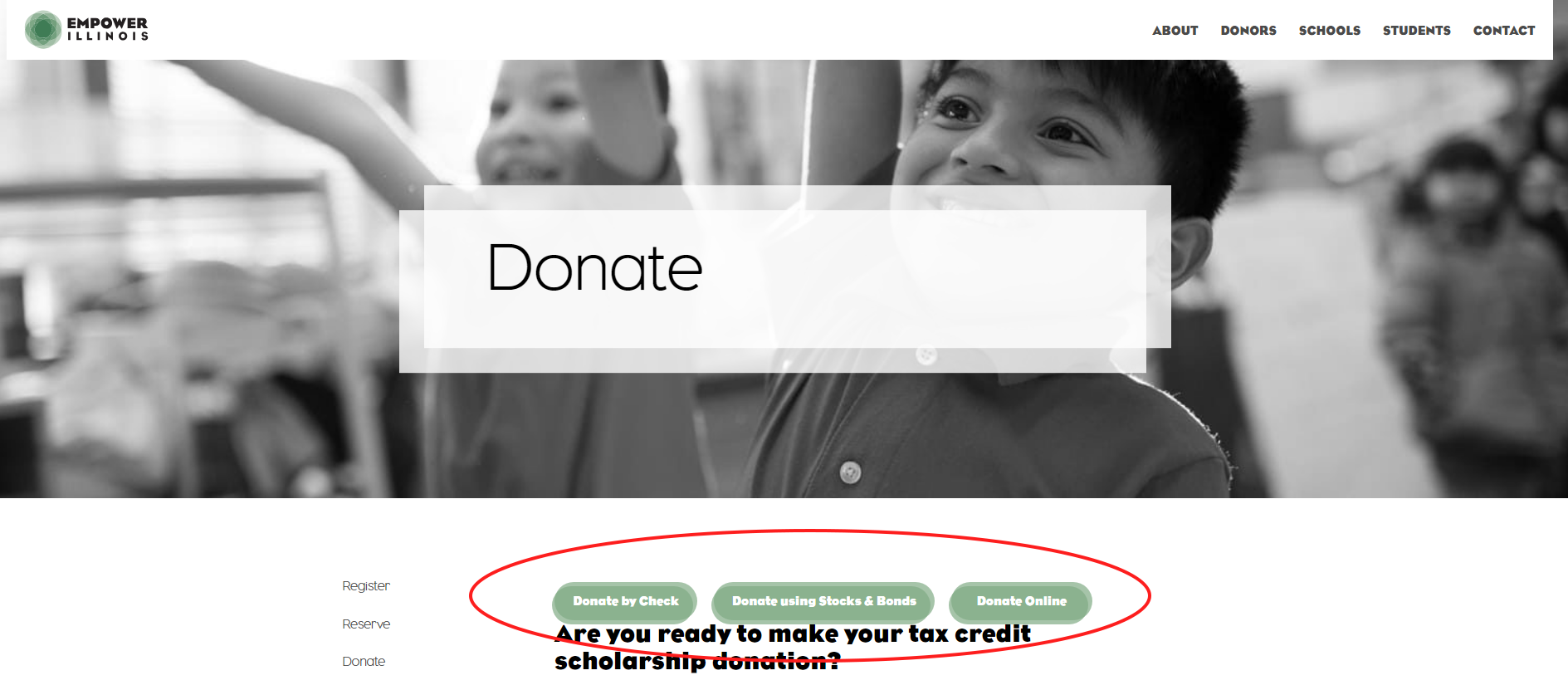

If you have everything prepared above, proceed to the Empower Illinois website at https://empowerillinois.org/donors/donate/

Below the page title and banner, there are three buttons labeled "Donate by Check," "Donate using Stocks & Bonds" and "Donate Online." Choose which option works best for you and follow the directions that appear.

Can any portion of a contribution be deducted for federal income tax purposes?

No. Donors cannot receive a federal deduction for gifts made through this program.

Can a taxpayer make a tax-credited contribution to a scholarship granting organization from a

donor advised fund?

No. Payments to Scholarship Granting Organizations are not treated as charitable contributions for federal income

tax purposes and therefore payments from a donor advised fund do not qualify for the tax credit. The payment of

tax-credited scholarship donations to a Scholarship Granting Organization must come directly from the individual or

corporate taxpayer.

Can donation credits be applied against Illinois’ personal property replacement tax that corporations

(including subchapter S corporations), partnerships and trusts are subject to?

No. The tax credit scholarship statute and regulations prohibit this

Can donors use marketable securities to make a donation?

Empower Illinois accepts marketable securities as tax-credited donations. Empower Illinois converts donated

securities into cash, per our gift policy. If the liquidated value of the donated securities does not cover the amount of

the tax credit reservation, donors must make up the difference. If the liquidated value of the donated securities exceeds

the amount of the tax credit reservation, the difference would be used by Empower Illinois as an unrestricted donation.

Does Empower Illinois accept distributions from Individual Retirement Accounts (IRAs)?

Empower Illinois is indifferent to the source of funds that are donated, except that the source of funds must be

owned by the taxpayer. If the source of funds is not owned by the taxpayer, they do not technically satisfy their tax

reservation. Any penalties or tax liabilities incurred by the donor for an IRA distribution are solely the responsibility

of the donor.

Can donations be made with a credit card?

No, credit cards are not an accepted form of payment for tax credit scholarship donations. ACH payments to Empower

Illinois’ bank is the preferred form of payment. Donations can also be made by check.

Can donations be anonymous?

Yes, donations can be anonymous if the individual or corporation chooses them to be.

What if donors don’t use up their Illinois tax credit in one year?

Barring changes to the current law, donors can carry the credit forward and apply it to their Illinois tax liability for the

following five taxable years.

If a business owner makes quarterly income tax payments to the state and later contributes to

an SGO, will the state refund the quarterly payments that have already been paid?

Yes, the taxpayer’s estimated payments in excess of the tax liability after credits will be refunded once the 2018 tax

return is filed.